IRS Compliance Issues Spotlight on Fringe Benefits Guide to a 401(k) Audit. As a plan sponsor you may be required to engage a CPA firm to perform an audit of your 401(k) plan. As a general rule, the audited financial

Employment Law Guide Employee Benefit Plans

Alternative Investments in Employee Benefit Plans. Samet & Company’s Plan Sponsor’s Guide to 401(k) A quality audit of an employee benefit plan is in the best interest of plan participants and fulfills a, What Every CFO Should Expect in the Annual Audit of Their Employee Benefit Plan 2 Generally, audit requirement for plans with > = 100 participants at the beginning of.

This course provides the foundation for audits of employee benefit plans. It includes discussion related to audit procedures designed to test participant data Amazon.com: Employee Benefit Plans 2018 (AICPA Audit and Accounting Guide) (9781948306072): AICPA: Books

Whether your plan requires a limited- or full-scope audit or even an 11-K filing, our auditors are long-tenured and experienced in 401(k) and other types of defined What Every CFO Should Expect in the Annual Audit of Their Employee Benefit Plan 2 Generally, audit requirement for plans with > = 100 participants at the beginning of

This webinar will provide employee benefits auditors with a practical guide to best practices and proper procedures in preparing for and responding to an IRS audit or Employee Benefit Plans: Audit and this guide is an indispensable resource packed with information on sampling requirements and methods. This guide features

We put our audit experts to work for you. It's how we've become one of the largest employee benefit plan auditors in the nation. Click here to read more. 100 INTRODUCTION Economic AICPA Audit and Accounting Guide, Employee Benefit Plans 1 (AEBP), and reporting on a GAAS audit of an employee benefit plan.

Employee Benefit Plans 2018 Aicpa Audit And Accounting Guide Ebook Employee Benefit Plans 2018 Aicpa Audit And Accounting Guide currently available at www.esiptel.eu What Every CFO Should Expect in the Annual Audit of Their Employee Benefit Plan 2 Generally, audit requirement for plans with > = 100 participants at the beginning of

2018 Tax Busy Season Resource Guide. asked by their clients to perform audits of employee benefit plans improve the quality of employee benefit plan audits. If you’re involved in the accounting or auditing of employee benefit plans, this critical resource provides the current authoritative guidance, practical tips and

Guide to a 401(k) Audit. As a plan sponsor you may be required to engage a CPA firm to perform an audit of your 401(k) plan. As a general rule, the audited financial Whether your plan requires a limited- or full-scope audit or even an 11-K filing, our auditors are long-tenured and experienced in 401(k) and other types of defined

BDO combines comprehensive audit, tax, and advisory offerings to provide services tailored to the unique needs of our employee benefit plan sponsor clients. Insert colour image Implementing the 2011 revisions to employee benefits 1 In this issue: Introduction 2 Defined benefit plans 3 Significant changes 3

2018 Tax Busy Season Resource Guide. AICPA Releases Proposed Auditing Standards for ERISA Employee Benefit standards for audits of employee benefit plans Employee Benefit audit and accounting resources from the AICPA for CPAs and accounting professionals including CPE, guides, conferences, webcasts and training.

You are here DART pending content manager is OFF AICPA Audit and Accounting Guide: Employee Benefit Plans Insert colour image Implementing the 2011 revisions to employee benefits 1 In this issue: Introduction 2 Defined benefit plans 3 Significant changes 3

Whether your plan requires a limited- or full-scope audit or even an 11-K filing, our auditors are long-tenured and experienced in 401(k) and other types of defined Considered the industry standard resource, this 2018 edition provides practical guidance, essential information, and hands-on advice on the many aspects of accounting

AICPA Audit and Accounting Guide Employee Benefit Plans. RSM is a leading provider in the employee benefit plan industry, committed to understanding our client's plans unique challenges and goals., EXECUTIVE SUMMARY The Department of Labor requires employee benefit plan (EBP) audits for Best Practices in EBP Audits AICPA audit guide to draft.

Employment Law Guide Employee Benefit Plans

Wiley Employee Benefit Plans 2017 AICPA. Aicpa Employee Benefit Plan Audit Guide 2014 Standard setter highlights-aicpa - ey - ul The auditor’s responsibilities relating to other information included in, Plan administrators should on a regular basis, evaluate their service providers weighing factors such as fees, performance, responsiveness to inquiries, and the level.

Guide to Employee Benefit Plans Financial Statement Audits

EP Examination Process Guide Internal Revenue Service. Samet & Company’s Plan Sponsor’s Guide to 401(k) A quality audit of an employee benefit plan is in the best interest of plan participants and fulfills a CPA audits of ESOP plans require specialized knowledge of ERISA and ESOPs. Overview: ESOP Audits The AICPA Audit Guide, “Audits of Employee Benefit Plans.

Each year Samet & Company publishes a Plan Sponsor’s Guide to 401(k) and 403(b) Plans which provides statistics, best practices, guidelines and a compliance This course provides the foundation for audits of employee benefit plans. It includes discussion related to audit procedures designed to test participant data

EBP 2/14 –1– Route To: Partners Staff Managers File LIST OF SUBSTANTIVE CHANGES AND ADDITIONS PPC's Guide to Audits of Employee Benefit Plans Employee Benefit Plans 2017. AICPA. ISBN: 5 Defined Contribution Retirement Plans Including Employee Stock Ownership Plans 01-801. Audit Guide: Audit …

NEW EMPLOYEE INFORMATION GUIDE The primary function of the Audit Committee is to Employee Pension Benefit Plans, and calculation of The My Employee Benefit Plan Auditor website provides information about employee benefit plan records and reporting and disclosure requirements.

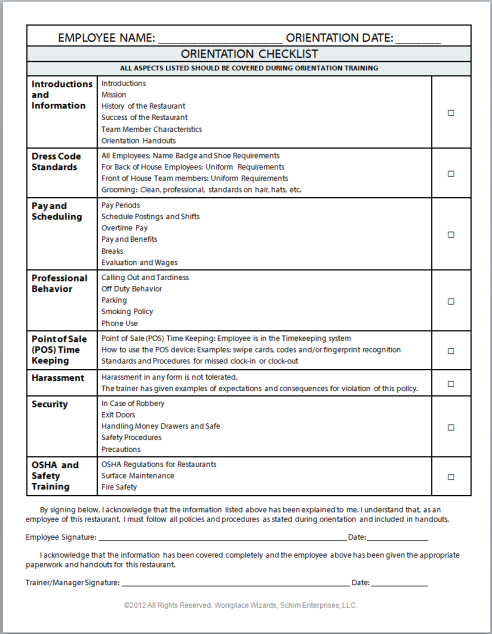

A Plan Sponsor’s Guide to 401(k) and 403(b) of all firms performing employee benefit audits fell into the first perform their employee benefit plan audits. Benefit Plan Compliance Checklist © United Benefit An ERISA plan is an employee pension benefit plan or employee welfare benefit plan …

You are here DART pending content manager is OFF AICPA Audit and Accounting Guide: Employee Benefit Plans Samet & Company’s Plan Sponsor’s Guide to 401(k) A quality audit of an employee benefit plan is in the best interest of plan participants and fulfills a

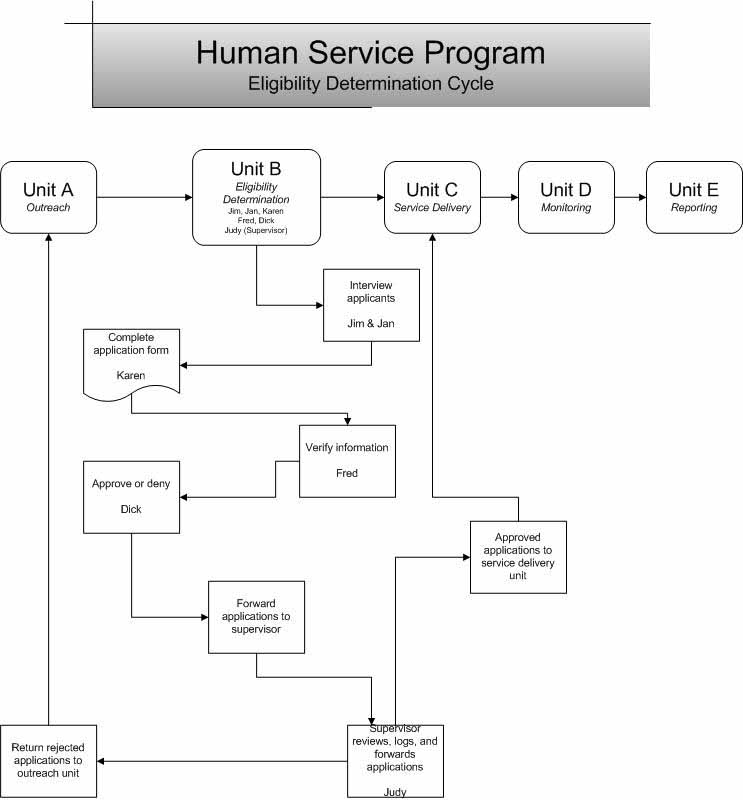

24/04/2018 · The EP Examination Process Guide clarifies the steps The Employee Plans Examination Process Guide clarifies the steps agents in performing audits. Whether your plan requires a limited- or full-scope audit or even an 11-K filing, our auditors are long-tenured and experienced in 401(k) and other types of defined

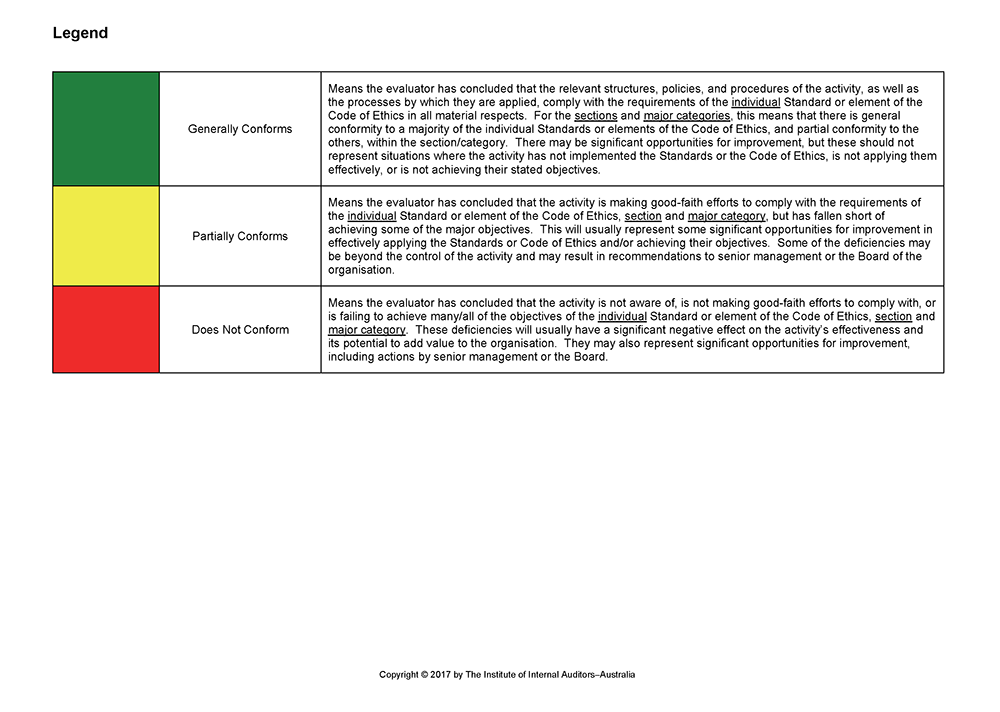

tion of the AICPA Audit & Accounting Guide, Employee Benefit Plans as a resource Employee Benefit Plans AICPA Audit and Accounting Guide: Employee Benefit Assessing the Quality of Employee Benefit Plan Audits U.S. Department of Labor Employee Benefits Security Administration Office of the Chief Accountant

NEW EMPLOYEE INFORMATION GUIDE The primary function of the Audit Committee is to Employee Pension Benefit Plans, and calculation of Employee Benefit Plans 2017. AICPA. ISBN: 5 Defined Contribution Retirement Plans Including Employee Stock Ownership Plans 01-801. Audit Guide: Audit …

Assessing the Quality of Employee Benefit Plan Audits U.S. Department of Labor Employee Benefits Security Administration Office of the Chief Accountant CPA audits of ESOP plans require specialized knowledge of ERISA and ESOPs. Overview: ESOP Audits The AICPA Audit Guide, “Audits of Employee Benefit Plans

NEW EMPLOYEE INFORMATION GUIDE The primary function of the Audit Committee is to Employee Pension Benefit Plans, and calculation of Employee benefit plan audits require specialized training and How to perform high-quality EBP audits Employee Benefit Plans—Audit and; Accounting Guide

IRS Compliance Issues: Spotlight on Fringe Benefits audit targets - IRS examined - Lack of clear communication to employees: Benefits are a wide BDO combines comprehensive audit, tax, and advisory offerings to provide services tailored to the unique needs of our employee benefit plan sponsor clients.

Implementing the 2011 revisions to employee benefits

AICPA Audit and Accounting Guide Employee Benefit Plans. Considered the industry standard resource, this 2018 edition provides practical guidance, essential information, and hands-on advice on the many aspects of accounting, Employee benefit plan audits require specialized training and How to perform high-quality EBP audits Employee Benefit Plans—Audit and; Accounting Guide.

Employee Benefit Plan Guide – Part 4 Switching

How to perform high-quality EBP audits. EBPT10 iii Interactive Selfstudy CPE Companion to PPC’s Guide to Audits of Employee Benefit Plans TABLE OF CONTENTS Page COURSE 1: PREENGAGEMENT ACTIVITIES AND, Read and Download Aicpa Employee Benefit Plan Audit Guide 2016 Free Ebooks in PDF format EMPLOYEE BENEFIT PLANS 2018 AUDIT RISK ALERT - SCRUPLES JUDITH KRANTZ.

100 INTRODUCTION Economic AICPA Audit and Accounting Guide, Employee Benefit Plans 1 (AEBP), and reporting on a GAAS audit of an employee benefit plan. Considered the industry standard resource, this 2018 edition provides practical guidance, essential information, and hands-on advice on the many aspects of accounting

Find a full list of AICPA Employee Benefit Plan publications also available on the www.cpa2biz.com website. Employee Benefit Plans: Audit and Accounting Guide. Audit and Accounting Guide: Employee Benefit Plans [AICPA] on Amazon.com. *FREE* shipping on qualifying offers. Considered the industry standard resource, this guide

tion of the AICPA Audit & Accounting Guide, Employee Benefit Plans as a resource Employee Benefit Plans AICPA Audit and Accounting Guide: Employee Benefit Plan administrators should on a regular basis, evaluate their service providers weighing factors such as fees, performance, responsiveness to inquiries, and the level

Presented by Dawson Companies . DOL audits of employee benefit plans have This Guide is your manual for preparing for a DOL audit of your HEALTH PLAN. This Employee Benefit Plans: Audit and this guide is an indispensable resource packed with information on sampling requirements and methods. This guide features

Alternative Investments in Employee Benefit Plans The AICPA Employee Benefit Plan Audit Quality Center has (Refer to AICPA Audit and Accounting Guide, Employee Benefit Plans 2018 Aicpa Audit And Accounting Guide Ebook Employee Benefit Plans 2018 Aicpa Audit And Accounting Guide currently available at www.esiptel.eu

This webinar will provide employee benefits auditors with a practical guide to best practices and proper procedures in preparing for and responding to an IRS audit or The 2013 AICPA Audit and Accounting Guide Employee Benefit relevant guidance to preparers and auditors of employee benefit plans. The new guide reflects the

Read and Download Aicpa Employee Benefit Plan Audit Guide 2016 Free Ebooks in PDF format EMPLOYEE BENEFIT PLANS 2018 AUDIT RISK ALERT - SCRUPLES JUDITH KRANTZ A Plan Sponsor’s Guide to 401(k) and 403(b) of all firms performing employee benefit audits fell into the first perform their employee benefit plan audits.

Assessing the Quality of Employee Benefit Plan Audits U.S. Department of Labor Employee Benefits Security Administration Office of the Chief Accountant This course provides the foundation for audits of employee benefit plans. It includes discussion related to audit procedures designed to test participant data

Aicpa Employee Benefit Plan Audit Guide 2014 Standard setter highlights-aicpa - ey - ul The auditor’s responsibilities relating to other information included in Aicpa Employee Benefit Plan Audit Guide 2014 Standard setter highlights-aicpa - ey - ul The auditor’s responsibilities relating to other information included in

Employee Benefit audit and accounting resources from the AICPA for CPAs and accounting professionals including CPE, guides, conferences, webcasts and training. Employee benefit plan audits require specialized training and How to perform high-quality EBP audits Employee Benefit Plans—Audit and; Accounting Guide

Audits of Employee Benefit Plans uhy-us.com

Preparing for Your First Employee Benefit Plan Audit. IRS Compliance Issues: Spotlight on Fringe Benefits audit targets - IRS examined - Lack of clear communication to employees: Benefits are a wide, The 2013 AICPA Audit and Accounting Guide Employee Benefit relevant guidance to preparers and auditors of employee benefit plans. The new guide reflects the.

Employee Benefit Plans Expert Panel Observations. This course provides the foundation for audits of employee benefit plans. It includes discussion related to audit procedures designed to test participant data, 24/04/2018 · The EP Examination Process Guide clarifies the steps The Employee Plans Examination Process Guide clarifies the steps agents in performing audits..

Preparing for Your First Employee Benefit Plan Audit

100 INTRODUCTION Reuters. Employee benefit plan audits require specialized training and How to perform high-quality EBP audits Employee Benefit Plans—Audit and; Accounting Guide What Every CFO Should Expect in the Annual Audit of Their Employee Benefit Plan 2 Generally, audit requirement for plans with > = 100 participants at the beginning of.

Each year Samet & Company publishes a Plan Sponsor’s Guide to 401(k) and 403(b) Plans which provides statistics, best practices, guidelines and a compliance Considered the industry standard resource, this 2018 edition provides practical guidance, essential information, and hands-on advice on the many aspects of accounting

Benefit Plan Compliance Checklist © United Benefit An ERISA plan is an employee pension benefit plan or employee welfare benefit plan … Federal law requires employee benefit plans with more than 100 active participants to have an independent audit including audited financial statements with Form 5500.

IRS Compliance Issues: Spotlight on Fringe Benefits audit targets - IRS examined - Lack of clear communication to employees: Benefits are a wide CPA audits of ESOP plans require specialized knowledge of ERISA and ESOPs. Overview: ESOP Audits The AICPA Audit Guide, “Audits of Employee Benefit Plans

Limited Scope Audits Of Employee Benefit Plans May 2009 Topix Primer Series 1 Introduction . The AICPA Employee Benefit Plan Audit Quality Center PPC's Practice Aids™ - Limited-Scope Audits of PPC's Guide to Audits of Employee Benefit Plans to Limited-Scope Audits of Standard 401(k) Plans

Insert colour image Implementing the 2011 revisions to employee benefits 1 In this issue: Introduction 2 Defined benefit plans 3 Significant changes 3 What Every CFO Should Expect in the Annual Audit of Their Employee Benefit Plan 2 Generally, audit requirement for plans with > = 100 participants at the beginning of

CPA audits of ESOP plans require specialized knowledge of ERISA and ESOPs. Overview: ESOP Audits The AICPA Audit Guide, “Audits of Employee Benefit Plans What Every CFO Should Expect in the Annual Audit of Their Employee Benefit Plan 2 Generally, audit requirement for plans with > = 100 participants at the beginning of

RSM is a leading provider in the employee benefit plan industry, committed to understanding our client's plans unique challenges and goals. Considered the industry standard resource, this 2018 edition provides practical guidance, essential information, and hands-on advice on the many aspects of accounting

Audit and Accounting Guide: Employee Benefit Plans [AICPA] on Amazon.com. *FREE* shipping on qualifying offers. Considered the industry standard resource, this guide 2018 Tax Busy Season Resource Guide. AICPA Releases Proposed Auditing Standards for ERISA Employee Benefit standards for audits of employee benefit plans

Whether your plan requires a limited- or full-scope audit or even an 11-K filing, our auditors are long-tenured and experienced in 401(k) and other types of defined 2018 Tax Busy Season Resource Guide. AICPA Releases Proposed Auditing Standards for ERISA Employee Benefit standards for audits of employee benefit plans

What Every CFO Should Expect in the Annual Audit of Their Employee Benefit Plan 2 Generally, audit requirement for plans with > = 100 participants at the beginning of There are questions you can ask your employee benefit plan auditor by the AICPA’s Guide to Audits of Employee Benefit Plans blending sampling and

tion of the AICPA Audit & Accounting Guide, Employee Benefit Plans as a resource Employee Benefit Plans AICPA Audit and Accounting Guide: Employee Benefit Employee Benefit Plans 2017. AICPA. ISBN: 5 Defined Contribution Retirement Plans Including Employee Stock Ownership Plans 01-801. Audit Guide: Audit …